Opinion about ayondo

If you are looking for opinions on whether ayondo a scam, you'll be glad to know it's not. On the contrary, it is a regulated and licensed company from the United Kingdom, so it is safe to operate with it.

| 🥇 Ayondo |

Ayondo

|

| ⭐ Evaluation | 5.0 / 5.0 |

| 🎲 Options for trading | CFDs and social trading |

| 💳 Underlying | more than 70 |

| ❤️ Software | TradeHub® |

| ⚖️ Regulation | fca |

| 🏆 Ayondo | Other brokers |

*84.1% of retail investors who invest in CFDs with this provider lose liquidity; therefore, you should consider whether you can afford the high risk of losing money.

ayondo is an online broker that specializes in CFD trading. On this page we want to inform you about their offer and security conditions, because we think it is the basis of a good decision when selecting the broker with which to trade. In this case, we have been very satisfied with what we have found during our analysis, but if you still want to see more brokers in which you can invest, be sure to check our about page CFD brokers .

Our experience with ayondo

As we said before, our experience with this platform has generated a very good opinion about its services. This is a company licensed in the United Kingdom, of German origin and that meets the security requirements that we believe necessary to deposit money and operate.

| Company | ayondo markets Limited |

| Address | Floor 4 Audrey House, 16-20 Ely Place, London EC1N 6SN |

| Registration number United Kingdom | 3148972 |

| FCA license number | 184333 |

| Phone | 34 91 084 02 49 |

| [email protected] | |

| Live Chat | No |

| They call back | No |

It is also a company that has opted for transparency. On their website you can find details, from our opinion important, but that not many competitors are willing to offer in such an accessible way, as their provider brokers are Commerzbank and Interactive Brokers. In short, a company that has our approval as an investment intermediary.

Is ayondo a scam?

We have no doubt that the broker we are dealing with in this analysis is not a fraud or that it is not engaged in scams either.

ayondo is part of the services of DonauCapital Investment GmbH. In particular ayondo GmbH is the company that manages the social trading , registered in Frankfurt, Germany and in the BaFin intermediary registers. CFD trading is offered by ayondo markets Limited registered in the UK and Wales and also with the FCA under number 184333.

Some of the security guarantees of this broker are the coverage of the Financial Services Compensation Scheme (FSCS), to which they have added a private insurance that covers up to £ 500,000 per client. So even before an insolvency of the company, there should be no problem to recover the money.

Of course, all economic transactions of customers with the company go through an encryption process, which should avoid any type of security incident through transfers.

In addition, something that investors are always grateful for, the company has a physical presence in New Zealand, with a branch in Madrid at Paseo de la Castellana 141, planta 19, 28046. Have there been any fraud problems with this broker before?

Some time ago, in January 2016, the FCA had to issue a statement to report that scammers were using the broker's name and its trademarks to scam their clients. This issue is something that the company can hardly do anything about except report it. To avoid surprises, you have to make sure that you are working on the official website of the broker. You can do this by clicking on the links of Estafa.info , as they are always checked before hanging.

Taking into account this mishap, the broker is absolutely safe and we should not associate its name with any type of scam carried out.

Investment offer

Investing online offers us the advantage of being able to diversify much more than through traditional banks with low or non-existent commissions. Therefore, when choosing the platform to trade, it is essential to check that the investment offer suits what we want.

In this case, the investment possibilities are very diverse. The possibility of social trading stands out a lot, since there are still few platforms that offer it. In addition, this broker specializes in CFDs, and as a complement to all this in its training section, in addition to static materials, it offers periodic half-hour webinars, in which it is explained how to get the most out of the investment.

CFDs

The number of CFDs available is really interesting. You will find 25 indexes, from Dollarpa, Asia and America. Among them is, of course, the IBEX 35 that requires a 4% guarantee and a spread of 4 points. As for currency pairs there are more than 35, several of which are the main crosses of the dollar with other currencies. Also included are the main shares of Dollarpa, Asia and America, as well as commodities such as gold, silver, platinum, oil and wheat. An offer that is not very common among brokers is the possibility of taking interest rates and bonds as underlying, something that is possible here, for example with 3-month NZDibor futures. And to complement the diversification possibilities, 10 ETFs are also offered, which complete the stock and index offering.

We really like that if you trade CFDs here, you will not be able to lose more money than the one available in your trading account. As you know, one of the risks of CFDs is that you can lose more money than invested, but in this case the loss would be limited to your balance, something that deserves a very good opinion. Large losses should be limited with stop losses, but unfortunately not all traders use them. The added danger is that in the case of large losses, the broker should be responsible for its clients, so that if many users, due to an unexpected market movement, lost more than they have, the broker could see their solvency compromised, also affecting users who, without having made a mistake in their investment, had their funds in the company's accounts. With the limitation that we tell you about here, this risk is eliminated. Without a doubt, a success.

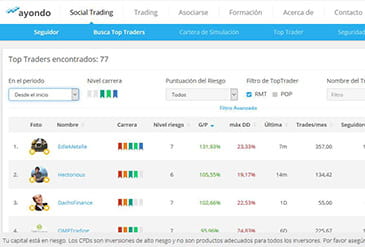

Social Trading

As you probably already know, social trading offers you the possibility to follow the operations of other traders. This can be used either to learn strategies or to make a profit, but logically it has the risk that if the other trader loses, you will also lose. Therefore, when it comes to social trading, the important thing is to check the transparency of the platforms regarding the operations, returns and risks of traders.

In this case, the truth is that we have been satisfied. Entering the profile of a specific trader, you will be able to see a graph with his performance as a trader since 2014, which is much more than the short twelve months that other platforms have accustomed us to. In addition, a table with the operations is displayed in the profile, so that the veracity of them can be monitored. It even offers you the option of using a simulator to see how a portfolio in which you had followed more than one broker would have evolved, with a maximum limit of 5.

Welcome bonus

Currently ayondo does not offer any type of welcome bonus or promotion. However, if this changes in the future, do not doubt that we will update this section to keep you informed of what you can achieve by opening a new trading account. For now, you will have to settle for the excellent investment offer that is available on this platform and the greater opportunities offered by social trading.

Ayondo payment methods

This company prioritizes safety first and foremost. That is why it is essential that the details of your trading account match your bank details. So when you register, be sure to put your details exactly the same as those that appear in the bank.

| Entry and payment channels offered | |

|---|---|

|

|

| Payment methods | bank transfer, credit and debit cards |

| Minimum deposit | 10 $ |

| Commission fee | Yes |

| Accepted currencies | NZD, GBP, USD, SEK, SKK, SGD and CHF |

| Withdrawal options | bank transfer, credit and debit cards |

Accepted payment methods are debit card, credit card, bank transfer. Due to their commitment to security, they will only accept your credit card if it incorporates the 3-D Secure system, available for both Visa and MasterCard. This system simply consists in that in addition to giving your card details, you will have to enter a small password that only you and your bank can know. In this way, the company makes sure that no one commits a scam thanks to your card data.

If you opt for the bank transfer, the first time they will ask you to send them a copy of it to the customer service. Also, make sure that in the concept of the transfer you put your name and trading account number.

Ayondo safety and regulations

As you have seen in the previous section on payments and security, this company takes the security of its customers' funds very seriously. To do this, he puts everything on his side to make sure that only you manage your money, deposit it or withdraw it. But what else should you know?

Having an FCA license ensures important aspects such as that the company has to give precedence to your interests over theirs in case of conflict of interest. In addition, the FCA asks them to verify that they have sufficient funds to carry out their intermediary activity, with the intention of minimizing the risks of bankruptcies. Even if a bankruptcy occurs, the fund and the insurance that we talked about in the security section would guarantee the money you have deposited. In addition to that, the company has the obligation to use segregated accounts in prestigious banks to keep the money of its customers, which means that it cannot use such cash to make payments that have to do with the invoices of its suppliers.

Customer service

Ayondo's customer service is generally good. There are enough ways to get in touch with them and while it's a shame that they don't have a live chat service, they make up for it with a phone in New Zealand and two headquarters also in our country. The one already mentioned above in Madrid and another in Barcelona at the address Via Augusta 29, floor 6 08006.

The opening hours are from 8:30 to 18:00 from Monday to Friday by phone and e-mail. In general enough, although those who operate in American markets and experience some problem, would surely like the afternoon closing time to be extended somewhat longer.

Functionality of the website

How could it be otherwise, the website perfectly fulfills its objective. The navigation is simple, with the typical header with navigation links and a central section where the contents that are being consulted appear. The investment platform is TradeHub® and allows you to invest perfectly, providing a highly stable service.

Mobile application

The mobile app of this broker is also managed with TradeHub® technology. However, we have to say that it is an aspect in which the company still has a lot to improve. At the moment it is only available in English, and it has several bugs or errors that are not of receipt. If you want to invest via mobile, we recommend that you take a look at our page with the best online brokers . Apple users can also find the corresponding application in iTunes.

Finding

Our opinion cannot but be positive, since we are facing a good broker, which offers a quality service. The possibility of doing social trading stands out especially, in particular because the available data on the traders to follow is better than what other platforms usually offer with social trading among their offer. The diversity of available underlying assets is solvent and the customer service also fulfills what is necessary.

What definitely tips the balance in favor of this platform is its high commitment to security. In this aspect, he offers us no doubt of his good work, he has the endorsement of being registered with the FCA of the United Kingdom and having taken proactive measures such as private insurance that covers the funds of his clients. Therefore, we recommend that you take the step, register and personally try the investment offer available here. In our opinion you will not regret it.

*84.1% of retail investors who invest in CFDs with this provider lose liquidity; therefore, you should consider whether you can afford the high risk of losing money.