Opinion about Finexo

Do you think Finexo is a scam? If you are worried about the possibility that it is a scam or carries out fraud or other illegal activities, you can rest easy, because it is not an illegal company. In this review we are going to analyze its security measures and regulations, so that you will find out because we dare to say that we are not facing a scam.

| 🥇 Finexo |

Finexo

|

| ⭐ Evaluation | 5.0 / 5.0 |

| 🎲 options for trading | CFDs |

| 💳 underlying | more than 300 |

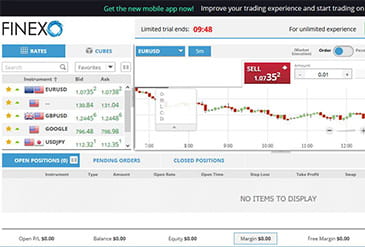

| ❤️ software | MT4, Sirix WebTrader |

| ⚖️ Regulation | cysec alone |

| 🏆 Finexo | Other brokers |

The platform offers online investment services to its users, mainly through the financial product known as CFD or contract for differences. As you know, it is a high-risk way of investing due to its great speculative and leverage capacity. This is something that every investor should control with their strategies, but what is not welcome is that to this is added the risk that the broker decides that its users cannot withdraw money for arbitrary reasons. Avoiding this is our goal and is the main focus of this analysis. Remember that if what you read here does not convince you, you can consult our list of the best online brokers .

Our experience with Finexo

Finexo is a serious and reliable broker that offers a very good amount of underlying assets, on which to trade through CFDs. Regarding the quality of the service, it is an above average company and, this being the case, it is not surprising the fact that it also meets the requirements that in Estafa.info we like to see in a company to say that it is a good option to invest. It is licensed by the Cypriot financial authority and follows its security requirements. Therefore, it is not a fraud.

| Company | Lead Capital Markets Limited |

| Address | 9 Kafkasou Street, Treppides Tower, 5th Floor, 2112 Nicosia, Cyprus |

| Registration number | 324232 |

| License number | 227/14 |

| Phone | 34-910-606-887 |

| [email protected] | |

| Live Chat | Yes |

| They call back | No |

By reading this review you will see that the service is not only good in the amount of assets and security, aspects that for us are the most important, but also in the customer service and many other important details to choose a broker.

Is Finexo a scam?

There are legitimate doubts about whether Finexo is a scam. The official name of the company is Lead Capital Markets Limited, so far everything is correct. The problem comes when we go deeper into the research, something that should always be done. If we enter the CySEC website, we will see that indeed Lead Capital Markets Limited, is a company registered with the Cypriot authority. The problem is that the website we are analyzing does not appear among the registered domains. In addition, if we enter the Lead Capital Markets Limited website, we will not find any mention of the Finexo website either. Since Lead Capital Markets Limited is trustworthy, the possible risk would come from an identity theft by the owners of the website.

In this situation, it is only necessary to contact Lead Capital Markets Limited directly and ask. That's what we did, we called the company's headquarters in Cyprus and they confirmed to us that indeed the website is legitimate and belongs to them.

At this point, why is Lead Capital Markets Limited trustworthy? The answer is that it is a company legally registered in Cyprus and licensed by the CySEC. Therefore, it is a company that must follow the precepts of the MiFID dollarpea. About this, we will delve into the security section.

Investment offer

This is one of the main factors to choose a broker and the truth is that we are facing one of the companies that offers its users a greater capacity for diversification. Later we will analyze the assets in more detail, but we can tell you that in total there are more than 300 different assets and that the selection is very good.

In addition to that, on the website you will find the classic educational section with short videos in which certain basic concepts of forex trading are explained. As usual, we cannot launch into investing just with these videos, but they do help us to review concepts and understand which aspects of investment theory need to be delved into. There is also an ebook worth checking out, a tutorial on MT4 and an economic calendar. Finally, we would like to point out that there is the possibility of opening a demo account, a functionality that in our opinion all brokers should have.

CFDs

One of the stars in CFD investing is the forex or currency pair market. Here you have at your disposal more than 45 pairs, with leverage 1:200. For the dollar alone, there are more than 15 pairs and you will also find the most popular among investors of the dollar, British pound and Japanese yen.

The diversity of company actions is even greater. You have at your disposal more than 180 shares with a leverage ranging from 1:5 to 1:20. Among them, there are 16 New Zealand stocks: Telefónica, Santander, Banco Popular, Inditex, REE, Grifols, Amadeus, Gamesa, Sabadell, Indra, Abengoa, Sacyr, Repsol, BBVA, Enagás and Iberdrola. You will also find American, Asian and many other dollar stocks.

To complement stocks, one of the best products are indices, because they allow you to make a large diversified portfolio of stocks of a certain place or sector. In this case, you have more than 25 indexes. There are representatives from all five continents, and the leverage ranges from 1:20 to 1:100. The IBEX 35 is among them.

You can also trade with raw materials. In this case the leverage goes from 1:10 to 1:100 and in total there are 18 commodities to trade: Crude oil and Brent, gold, silver corn, wheat, coffee, sugar, soy, cotton, natural gas, rice, copper, palladium, platinum, cocoa, aluminum and zinc.

We finally found the bonds. There are five with 1:100 leverage and the fact that there are them in Japanese yen, pounds, dollars and NZD is very valuable.

Welcome bonus

Being regulated by the CySEC and after the tightening of the requirements of the same on bonuses, this broker, like the vast majority of others, has chosen not to offer any welcome bonus.

From Estafa.info we will be attentive in case this changes in the future and if so, we would inform you about it right here. In the same way, we could inform you of new offers and promotions. But for now, you will have to settle for the platform's offer to invest itself.

Finexo payment methods

In this section the managers of this investment platform have not complicated their lives and although they do not offer many payment methods, they do offer those that the vast majority of users use in New Zealand: credit or debit card, Skrill, Neteller and bank transfer. Of the most popular payment methods, the only one we miss is PayPal, an endemic evil among CFD brokers .

| Entry and payment channels offered | |

|---|---|

|

|

| Payment methods | credit or debit card, Skrill, Neteller and bank transfer |

| Minimum deposit | 1 000 $ |

| Commission fee | Yes |

| Accepted currencies | NZD |

| Withdrawal options | credit or debit card, Skrill, Neteller and bank transfer |

One of the few "buts" that we have found in our analysis has been that the minimum income to open an account is $1000. Undoubtedly, this is a reasonable amount for all those who are going to invest seriously, but many users prefer to try the platform with some real money first. This is not possible. Although what it is, is to try the platform with your demo account without making any type of income.

It should also be noted that in the case of no activity for sixty days, the broker may charge a monthly commission of $10 for inactivity. However, this does not mean that they will make it safe. In any case, if you are not going to operate, it is best to take the money out of the account to avoid greater evils.

Finexo Security and regulations

Once it has been clarified that Finexo belongs to Lead Capital Markets Limited, let's see what repercussions this fact has for the security of users: First of all, they must make sure that when they execute an operation, it is carried out in the best possible conditions for their client, taking the necessary measures so that in case of conflict of interest, it does not interfere with the operation. In addition, customer deposits are covered up to an amount of $20,000 in the event of insolvency or non-payment by the company, thanks to its membership in an investor compensation fund.

Apart from this, the company has the obligation to categorize its clients according to their investment knowledge, in such a way that private clients have greater protection.

As a complement, in April 2014, the company was registered with the CNMV under the number 3698. However, this registration has consequences only for information purposes. The only implication is that the CNMV will echo the warnings that other financial authorities in other countries may make about this investment platform if it were the case that they consider it necessary, due to problems or user complaints.

It is always reassuring to know that financial authorities from countries such as Germany, France, Ireland, the United Kingdom, Italy, Austria, Sweden and the rest of the states belonging to the Dollarpea Union, have recognized the possibility of the company offering its services to citizens residing within its borders. All this derives from the license in the CySEC, since a company accepted in one EU country has the right to offer its services in the other countries. However, not all companies make the effort to register with the other authorities as foreign companies offering services. This act is nothing more than a sign of transparency. However, anyone who must file a claim with the company must do so through the CySEC, and not through the financial authority of their country. Hence we say, that these records are important only in an affirmative way.

Customer service

Customer service is available by phone in New Zealand at the number you can see in the table above with the company's data. The opening hours are from Sunday at 9 p.m. to Friday at 9 p.m. You can also contact them in English via email at [email protected] , as you can see the domain is different from that of the platform, but it is simply because it is an email from the parent company.

Functionality of the website

The website works perfectly and is easy to use. It is translated into New Zealand in everything necessary to carry out the investment, but not the terms and conditions, something that we certainly miss in a serious broker. The investment platforms are the well-known MT4, which allows investing with total versatility and Sirix Webtrader which also offers an attractive interface.

Mobile application

The Sirix Webtrader software is available on Google Play, but the truth is that it is a very green product that we do not recommend. It barely has a few downloads, it does not have any feedback from users, it is inaccessible from the official website of the broker and the company data they offer on Google Play are those of their subsidiary in Seychelles. If you want to trade from mobile, better choose another one of the brokers to invest in forex what we suggest to you in Estafa.info .

Finding

We would say that it is an excellent broker if it were not for the details explained in the two security sections. Although the broker is safe and it is not a scam, it is as important not to be, as not to look like it. Therefore, we hope that they will do their homework soon and update the corporate website, so that users do not have doubts about the legitimacy of the URL. We have made sure of this, and that is why we can affirm that it is true that the website belongs to a company registered in Cyprus, which has the relevant licenses.

Another weak point is a mobile app that has not convinced us at all. But if what you want is to invest from the desktop computer, the truth is that the large number of available underlying assets and the good attention they give to the New Zealand market, something that is not very common among online CFD brokers, make this broker generally deserve a positive note.

Not entirely convinced? Try it for free with your demo account, you have nothing to lose.